ASPECTS CONCERNING RESPONSIBILITY AND LIABILITY IN FINANCIAL MANAGEMENT OF LOCAL COLLECTIVITIES IN ROMANIA

Florin Oprea - decembrie 5, 2016Florin OPREA[1], Mihaela ONOFREI[1]

e-mail:onofrei@uaic.ro

Abstract

The trajectory, directions and pace of development of a subnational collectivity are often considered a result of primary influence of certain objective factors (such as economic base, fiscal potential, geo-strategic position etc.), placing less emphasis on the quality of the local financial decision-making and, therefore, on the responsibility of the various involved actors. In this context, our paper aims at adequately positioning the concepts of responsibility, accountability and liability of the actors involved in local financial management, highlighting the correlation among their legal role, their deontological/moral/civic duties relevant in this context, namely their incidental social and legal liability.

Key words: local financial management, social responsibility, legal liability, Jel Code: H7, H79

Balanced, harmonious development within a state collectivity, namely attenuating or eliminating inter- or intra-regional development discrepancies is a major challenge in the governance process, generating extensive debate about the administrative-territorial reform and its efficiency, development sources etc.

MATHERIAL AND METHOD

In this context, the intrinsic quality of the involved actors and their manifestation through administratively impacting actions is often pushed in the background and considered a „set” element, for whose molding one can just hope, without particularly pursuing the aspects of responsibility or accountability of those concerned. Basically, the initiated reforms refer, in most cases, to generous values such as „making civil service professional”, „redefining the role of the state”, „improvement of public policies” etc., focusing more on the effects rather than the real cause. Seen from this perspective, the effectiveness of the well intentioned reform becomes dependent on the manner and extent of understanding and assuming by those involved of their social, moral and legal mission and of their responsibility and liability in relation to concrete social inclusion, which can be either an accelerating factor for obtaining positive effects or an adverse one. In other words, the (social, moral and legal) responsibility, accountability and liability of the involved actors become a key term in the equation of local and national development, with profound and long term impact. Our paper focuses on the sphere of manifestation of local financial management, thus putting into question the roles, responsibilities and liability of public local authorities involved in the budgetary process and, implicitly, of the central authorities with which they relate, and also of the members of the local collectivity, as stakeholders of local administration.

RESULTS AND DISCUSSION

Particularities of local financial management and implications concerning responsibility

The particularities of financial management of local collectivities derive primarily from the specific framework of operation of this activity, having legal regulation as an essential feature, which implies the association of specific decisions with the legal liability of those involved. Undoubtedly, the activity of companies is also conducted under the impact of legal constraints, but the extent to which legal rules restrict the freedom of decision of the involved actors is different and thus naturally producing different effects. In the case of companies, decisions concerning the company’s financial structure, funding sources of the activity or the distribution of dividends are taken completely freely, in accordance with the interests of their stakeholders. In the case of local collectivities, such decisions are strictly regulated, the sources of income of local budgets are established by law, ordered according to the principle of specialization, the locally financed expenditure having a similar regime, local loan can be promoted only under the law of local public finance etc., on the background of legal recognition of a certain degree of decisional discretion (the right of assessment). Unlike a company (private financial manager) which has the freedom, the possibility to act in one way or another while complying with the legal norms relating to economic activities, public authorities (local financial managers, in our case) have the obligation to perform certain actions, to take certain financial decisions, thus materializing the content of the public law competence they hold.

Under these conditions, a possible failure or faulty fulfillment of legal obligations is obviously associated with the legal liability of the concerned public actors, but this aspect should not circumvent the need for their social, moral and political responsibility, deriving at the level of top manager from the specific democratic mechanism of acquiring legitimacy correlated with the right of assessment (discretionary power). In other words, the absence of responsible manifestation materialized in a passive-defensive attitude in the exercise of their legal attributions, namely the lack of proactive socio-professional insertion of local financial managers, them acting as mere executors of the law and their lack of supplementary efforts to attract resources, the establishment of expenses destinations by putting political capital before local interest, the formal involvement of citizens in the process of budget decision-making etc., equally constitute „violations of rules” (political, deontological or moral, as is the case), that will arise the corresponding liability of the elected officials before the voters or even their own political parties.

The aspects mentioned above show that an essential feature of financial management of local collectivities is that it has a limited framework of action. This observation should not be generalized, given that in the exercise of the same attribution local decision-makers have the so-called discretionary power, which leaves open the possibility to choose between several potential solutions to achieve the same objective, in many cases, being allowed to choose even the moment of taking that action. Local autonomy allows decentralized public authorities, besides the legally regulated appropriate management of the production of public goods of local interest, to freely initiate, conduct and capitalize, to the interest of the subnational collectivity, any other public activities approved by their members as being of local interest. In our view, this prerogative must be understood in terms of responsibility as an obligation and not as a mere possibility to act, whereas the conceptual core of local autonomy can be capitalized exactly this way. Especially in the case of economic actions conceived or promoted by local authorities or in the case of economic entities having local subordination (interest), the decision-making procedure and the used methods are highly similar to those in the private sector. In the matter of taken financial decisions, the quantification of the costs and results (especially the financial ones) of a program, their comparison and taking, based on them, the decision to implement or not the program (cost-benefit analysis) is useful and recommended both in the sphere of private activities and public activities (for some public financial decisions they are actually mandatory). What appears important in this context, in terms of responsibility and liability, is that in the regulation of financial flows between the economic entity and the administrative one to which the former is subordinated, the regime of self-financing be imposed, with all legal consequences arising from here, avoiding unconditional budgetary support in case of financial difficulties and the appearance of softbudget syndrome, eroding the financially responsible decisional attitudes.

With strict reference to the decisional process, the particularity of the legal constraints of the financial management of local collectivities is visible especially in the phase of documentation of this process, but not only. If the private decisionmaker has the (not recommended) possibility to decide without a certain prior argument, but relying on his own „financial instinct” and assuming more or less consciously the correspondent risk, the public decision-maker is bound by the legal framework to argument the decisions, according to their specific. Thus, analyzing the legal framework of the financial management of local collectivities, one notices the existence of some procedures prior to taking these decisions (for example, the explanatory note imposed in case of concession of public property, the argumentation note for the local budget etc.) (for example, the notice, agreement, argumentation note, proposals, projects, feasibility study etc.), or of concomitant procedures (quorum, majority) or of subsequent ones (authorization, confirmation, communication). Likewise, public (financial) decisions are subject to both an internal (administrative) and/or external hierarchical control and to a jurisdictional control, thus, if need be, the legal liability of the involved actors can be arisen. In terms of control, one must notice that non-compliance with the appropriateness requirement as a mandatory feature of public decision (for example, under the provisions of Government Ordinance 54/2006, the intention of concession of public property compels the administrative authority to make a study of appropriateness, as a first step) may become grounds for its cancellation, while in the private sector the withdrawal of the decision (similar to the revocation of the administrative decision) or the modification of certain decisions is not subject to express legal conditions, and must only be included within the possible contractual limits undertaken.

From another perspective, we note that with companies there is not a set of legally established principles for financial management, while at the base of financial management of local collectivities lay such principles. These fundamental rules are not always explicitly named as such, but by the conveyed content they set a clear link with the local financial decisional process. Therefore, principles such as legality, appropriateness and efficiency of public administrative activities, decisional transparency and citizen participation in public decision-making, the preeminence of the public interest in relation with the private one, decentralization or the principle of motivation of administrative actions/measures have direct implications on the conduct of specific activities of financial management of local collectivities, being a real support for the accountability and responsibility of the actors in the local financial decision-making process. Among these principles, the ones of legality, of appropriateness, of efficiency, of decentralization, local autonomy and subsidiarity, of collaboration and cooperation of public authorities have substantive effects on the financial management of local collectivities.

From another perspective, customizing financial management of local collectivities is also supported by the typology of specific financial decisions, which we do not detail, as specialty literature offers several criteria to classify them (Filip and Onofrei, 2000, pp. 31-35).

Given the mentioned particularities, it appears that the normative aspect of public financial activity highlights the legal liability of the involved decision-makers, but carrying out their concrete activities also involves, to a large extent, civic, moral or political responsibility, as well as an imperative of accountability through actual decisions, as we shall further present.

Processes and actors of responsibility and accountability in local financial management

Financial management of a local collectivity represents a set of principles, methods, techniques and tools used by public decision-makers, which is oriented toward achieving the goals of the public entity, based on resource economy, effectiveness and efficiency of mobilization and use of financial resources (Oprea, 2013). If in the private sector the management of financial activity is considered „the cause of the success or failure of the enterprise” (Onofrei, 2007, p. 13), in the public sector one can consider that financial management becomes the main source of efficiency or inefficiency in the use of public money, having direct implications firstly on the local economic development, but also, on a broader level, on the relationship between local authorities and the collectivity members, on local identity, on local autonomy and on its effective exercise etc. Against this background, public financial management (and implicitly that of local collectivities) seems, under current conditions, a primary component of the management of public entities, and the transparency and prudence exercised by public authorities within local financial management is a crucial requirement for the integrity of the public (local) sector, for gaining and maintaining the trust of local collectivity members.

Regarded in light of the manifestations of will (legal documents) and the public financial decisions they materialize into, local financial management appears in the foreground as ongoing actions matching the public (especially, local) budgetary process, which highlights a first category of involved actors: the executive and deliberative local public authorities which decide on the collectivity budget and therefore the taxpayers. However, such a traditional view is much too restrictive and hence inaccurate regarding the sphere of involved actors and their role; we must take into account, on the one hand, that establishing the identity of local budgets is mandatorily done in relation to those of central administration (firstly, the state budget), also bringing forth the responsibility of these decisionmakers and, on the other hand, that the members of the local collectivity are not mere subjects of extracting fiscal resources, but partners throughout the entire budgetary process, joined by other stakeholders of the local collectivity/ administration (creditors, investors, other foreign partners etc.).

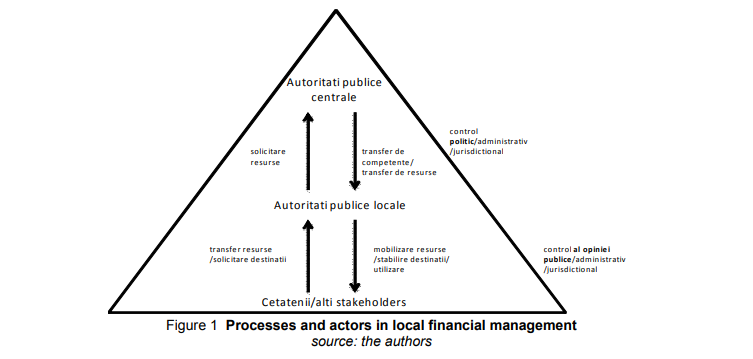

Schematically, the enumerated processes and roles can be represented this way:

It can be seen from this figure that the actors involved in local financial management can be found in different situations, depending on the stage of the budgetary process, playing different and complex roles, which implicitly determine the responsibility of each of them and it also reveals the main channels of accountability, usable according to necessities, which we will elaborate below.

Connections and channels for the expression of responsibility, accountability and liability of the actors in local financial management in Romania

One of the few public policy issues over which there is no controversy is that local development is an absolute priority, along with the need for regional balance. In this context, however, the need for financial support is considered a task of the central authority, although local autonomy allows for the sources of growth to be explored even at local level, by efforts of the subnational collectivity. In this context, the public budgetary process reveals, in the stage of budget elaboration, a first aspect of responsibility with clear possibility of being a channel of accountability of local authorities, consisting in the sizing of the transfers to be carried out toward local public authorities in the budgetary year for which the projection is made.

Under current legislation, the stages of the budgetary process partially reverse the natural course of a budgetary projection, establishing that „the Ministry of Public Finances transmits by June 1st of each year […] a framework-letter which will specify […] the limits of the amounts shared from certain State budget revenues and of fundable transfers […] in order for the budget administrator to develop the draft budgets. The main budget administrators of the state budget […] transmit to local public administration authorities the corresponding amounts […] with a view to including them in the draft budget”. The main issue that arises is that of the trigger of the sizing of local budgetary expenditure, implicitly omitted in this context, meaning that the base of fundaments is no longer represented as it would rationally be required by the real local social needs and their priority, but by the existence and volume of the amounts to be allocated, thus creating the potential danger of establishing new destinations only because there are allocated amounts to be spent. In fact, the projection of budgetary expenditures must rationally come before the identification of resources covering the expenses, programming the use of public financial resources only on condition that they are really needed. Viewed in terms of responsibility/accountability of those involved, one can notice in practice a permanent race for increasingly more consistent transfers from the central budget to local ones, fueled also by the goal of gaining political capital, moving in the background the imperative of efficient use of the allocated amounts, with negative effects on the accountability of local authorities, for which a pathway of dependence on the resources obtained through transfer is created. In this context, the differential treatment of destinations for which transfer of resources is requested, namely the replacement of the administrative transfer with the loan between public budgets for destinations of positive expenditures, can adequately contribute to raising the accountability of local decision-makers, who have to reimburse those amounts.

Regarded in light of the applicable control, the primary task rests with political control (of the Parliament), which has the duty/competence to amend and adopt the budget of central administration, as well as the budgetary execution closing account, with all the ensuing legal consequences.

In the phase of elaborating the project of the local budget, legal liability (competence) lies with the executive authority (drafting the project) and with the deliberative authority (adopting the local decision). Nonetheless, the law recognizes the prerogative of local collectivity members to participate in public decisional processes, by requiring the meetings for the debate/approval of the local budget to be public, which is a positive channel of manifestation of public opinion control on the sources and destinations of local budgetary resources. In this context, the initiative must belong to citizens, who can establish various types of public action structures and who must knowingly integrate in determining the course of local development.

Citizens’ responsibility should not be limited to the requests/establishment of the destinations of local budget resources, but must be complemented by their efforts in the formation of budgetary resources. In other words, the very members of the local collectivity, who claim the ensuring of an enhanced quantity or quality of local public services, should understand and assume the need to produce more or better as a support for gathering of the public funds necessary to provide these services. Establishing a link between the granting of funds for balancing from a superior budget and the collectivities’ (local authorities’) own effort, reflected mainly by the degree of collection of local public revenue, would be a useful manner of generating the interest of local agents, which can be promoted in democratic conditions, with certain corrections and reserves, without the risk of being challenged.

Viewed from the perspective of fiscal federalism, the principle of responsibility starts from the premise that local decision-makers should be responsible for the preferences of those they represent (local collectivity members). This requirement emphasizes not only economic but also political considerations in the sense of local (semi)representative democracy. To meet these requirements, local decision-makers should rather have their own resources than benefit from grants or transfers (especially among those conditioned) from the central authorities. To promote desirable local policies, according to the preferences of the members of the local collectivity, local authorities should be able to (discretionary) determine the rates of taxation for their earnings, but this is a situation that implies some conceptual reservations regarding the potential effects of the recognition of a (full) „local fiscal sovereignty”. Therefore the responsibility of decision-makers refers to different aspects: political responsibility (to the voters) or legal liability, through administrative or jurisdictional control of the decisions of local authorities (Bovaird and Löffler, 2009, p. 55). On the other hand, the action and effectiveness of the principle may be questionable if there is not vision and overall commitment, meaning that responsibility should necessarily be extended (rediscovered, stimulated) to the members of the local collectivity, who, in return of their request for services, must assume „the payment” of these services by mandatory contributions set by the „supplier” (the local authority).

The responsibility of local decision-makers, however, is not only a function of their discretionary power in setting local budgets revenues and the destinations they will receive, but it is possible and necessary in the practice of a system of grants for balancing from the central budgets. In other words, the freedom of decision on local budgets revenues and their chosen destinations is only a necessary condition, but not also a sufficient one to actually ensure responsibility and proactive attitude of local authorities. As an example, we invoke the recognition of the legal possibility of local authorities to contract public loans for financing the expenditure in local budgets that cannot be covered from their own revenues. Except for the establishment by the central authority of certain limits of indebtedness or even the requirement of establishing a reserve or guarantee fund, the possibility of some local shortages becoming chronic remains theoretically open, containing the premise of some national imbalances, that can determine the interference of central authorities for the repayment of the borrowed amounts, the lack of responsibility of some local authorities having repercussions at fiscal level on other matters of taxation (also).

Admitting that the logic of functioning of the state and the budgetary system allows such a repercussion, we would like to present some examples of good practice from other systems, when the responsibility of local decision-makers has not produced the expected results. Thus, in the German system, the authorities of the Land may compel the local authority to the execution of some not assumed obligations in the matter of public services, can dissolve the local council and dismiss the local executive authority before the end of its mandate, temporarily replacing these local elected authorities with a Commissioner of the Land, practice also encountered in the United Kingdom or Ireland. For cases of financial difficulties of local collectivities, the system of giving grants is established in Belgium, Estonia, Finland, Italy, the Netherlands or Hungary, being interesting the model of the Belgian region of Wallonia, which conditions the granting of resources by the preparation of a recovery plan that ensures budgetary balancing in the coming years, plan that is submitted for approval to the central authorities of the region. In our view, this practice should be generalized as outside of an anticipation of the development of the local collectivity in difficulty and subsidized, that is outside it responsibly assuming the obligation of an ascendant course of local development, the grant will serve as a powerful demotivating factor, embodying the manifestation of soft-budget. Hence, the municipalities approaching decline will have the „certainty” of the intervention of other superior collectivities, through their budgets, which would encourage an attitude of weakening responsibility or prudence in the use of local financial resources, and unconditionally „saving” such authorities would set an example that could rapidly be converted into a type of precedent for other collectivities who may face similar situations. Furthermore, the discussion and approval of the recovery plan, which will be assumed by the local collectivity, should be made with the involvement of the representatives of the other local collectivities that actually support the financial effort. This practice could fit on a line already existing in some European countries for the „negotiation” of the size of the transfers for balancing to be granted (as in Cyprus, Denmark, Estonia, France, Germany, the Netherlands (for example, Dutch municipalities and provinces are represented in this context by two associations: the Union of Dutch Municipalities and the Association of Provincial Authorities. These associations are often the initiators of extensive reform projects, and central authorities always consult them in taking decisions that affect or involve in any way the local public sector. The obligation to consult such associative structures is currently regulated for some decisions in Romania also), Slovakia, Spain and Sweden) and would have the advantage that local representatives know better the local practices concerning the peculiarities in terms of financial management of local collectivities, thus being able to more realistically appreciate the relevance of the recovery plan through the involved efforts, the directions towards which it is channeled and its expected effects.

A more sensitive aspect, raised from the point of view of the actors involved in local financial (budgetary) decisional process, concerns, in our opinion, the existence, or more exactly, the need for specialized character of the institutions with attributions in the matter, as „specialization” expresses a requirement of rationality of processes and is closely correlated with decisional effectiveness or efficiency, which it naturally conditions. At least theoretically, the „top” local financial management, as complex decisional process, has rational bases by integrating the system of targeted decisions into an institutional architecture that simultaneously meets both the need for representation or local democracy, as well as the need for specialization. But then again, for the local decision-making system, the components are in different relationships, as can be seen in the following figure:

Figure 2 shows that the local decisional system is conceived, in terms of democratic architecture, similar to that central one, integrating a local deliberative body (the Local or the County Council) and an executive one (the Mayor or the County Council Chairman), associated with different structures (committees, departments, services, offices etc.) which are also specialized (the Budget Committee, the Department of Local Public Finances, the Financial and Accounting Service etc.). At first glance, the local executive seems to lacks the direct connection with the specialized body in financial matters corresponding to Government (represented by the Ministry of Public Finance), but the analogy of fundaments is continued in the legislation of public finances, and legal provisions state that, in the local budgetary process, the decentralized authorities of the mentioned ministry (the General/Regional Directorates of Public Finances) are bound to offer specialized assistance in performing specific activities (according to current regulation, these authorities provide technical assistance on the development and execution of local budgets, collaborating to that end with the administrative-territorial authorities). This regulation obviously provides the premise of good functioning of the local financial-budgetary decisional process, the only reservations could concern the way the ones involved concretely understand the need or the content of administrative „collaboration”, as an expression of their own social responsibility, while the local financial manager is not expressly required by law to request such technical assistance, in its turn undefined. As long as it is an obligation of means and not of result, we can admit that the possible, borderline illegal, circumvention of responsibility and the breach of professional deontology by the involved actors, potentially favored by the excessive politicization of public administration, could make a request for specialized technical assistance to only have the effect of obtaining a „cemetery of numbers”, difficult to really interpret/exploit by an unqualified local main budget administrator.

We do not exclude the idea that the consecration of the institution of public manager or city manager, designed from the perspective of assuming/exercising his attributions of main budget administrator, according to models proven functional, could become a factor of support and appropriate enhancement (and obviously, necessary, under current conditions) of the responsibility and the quality of local financial management act, but the Romanian system is still too heavily influenced by tradition and the concept of a representative (and not a technocrat) local executive.

A less direct involvement with the local financial-budgetary decisional process, but of importance and with potential consistent effects, also rests with other local or central authorities (for example, the Commission for authorization of local loans), especially in terms of exercising control over the acts of local authorities. We refer here primarily to the Institution of the Prefect, as holder of the administrative control, which may appeal to the administrative court on the legality of the acts of the authorities of local public administration, which may lead in extreme (and also, unwanted) cases to a whole range of effects – from the suspension of execution of the contested administrative acts, up to the blocking of financialbudgetary flows and their corresponding projects. Analyzing the current regulation, we notice that out of the Prefect’s attributions, his prerogatives with more direct implications in the financial management of local collectivities are: to act for the achievement in the county of the goals contained in the Government Program and to order the necessary measures for their fulfillment in accordance with the competences and the attributions assigned to him by law, to order implementation measures for the national policies decided by the Government, to verify the measures taken by the Mayor or the County Council

Chairman in their capacity of representatives of the state in the administrative-territorial unit, to verify the legality of the administrative acts adopted or issued by the County Council, County Council Chairman, Local Council or Mayor and to act to defend legal order, public order and the safety of citizens, as well as the rights and freedoms of citizens, as provided by law.

These legal prerogatives reveal that, in substance, the Institution of the Prefect was conceived also as a means of representation of the Executive in the territory, which would ensure at this level a better possibility of autonomous, discretionary manifestations of local authorities staying within the legal limits. From this point of view, one would emphasize the need and possibility of granting the Prefect wider prerogatives in the matter of local budget, a good example in this direction being the French one. Practically, the current prerogative of the Prefect to act for the achievement in the county of the goals contained in the Government Program and to order the necessary measures for their fulfillment, would find real support for achievement if in the local budgetary process (in the development phase of the project of budget), the Prefect would have the expressly stated possibility to request the introduction of some budgetary credits for regulated public services, but improperly treated by the local authority in relation to the requirements of „the goals contained in the Government Program”, possibility which would be subject to judicial review. Although current legislation does not prohibit the Prefect this possibility, the instruments of democratic participation being equally recognized to him, an express provision, rationally and impartially exploited, could create a more appropriate bridge between local administrative authorities, with beneficial effects for the local government as a whole.

From the perspective of providing local public goods, stimulating the responsibility of those involved requires first that the services provided by public authorities be reasonably financed by taxes borne by the beneficiaries of these services and not offered (always and in all cases) for free. This way of promoting the supply of public utilities is likely to lead to a more rational exploitation of the financial resources of the nation, making the beneficiary accountable, who, once forced to support part of the cost of the service, will stop consuming services which are not inevitably necessary to him, but which he would have consumed if they were for free. On the other hand, the local financial manager cannot have a passive role, limited to financing the strictly necessary local public services, but must act similarly to the financial manager of a company, be active and concerned with the future quantitative and qualitative increase of the economic and social base of the collectivity. In this context, the local public financial manager’s ability to predict the structural, quantitative or qualitative changes in the request of public services is an important factor, among those affecting the viability of the act of financial management of local collectivities.

To the extent to which taxpayers can make the connection between the offered services and the incurred taxes, the latter can be interpreted and may manifest like a price (as in the case of a private service), being more easily accepted and borne by the beneficiaries (subjects) when they notice an appropriate performance or even an increase in the volume or quality of the provided services. Under local autonomy, the principle becomes entirely possible and compulsory to capitalize, despite (unfounded) interpretations according to which local financial managers do not have the necessary means to ensure it, on the grounds that such a decision (to attribute the sources of income) would belong to (central) legislative authorities. Basically, beyond the limit of local public services compulsorily to insure (thus, arising from the law) and against which assigning different sources of revenue is positioned, local public authorities can develop any other services that would be required through the preferences expressed by the members of the subnational collectivity, for which they have the right to charge special fees, which will be used in the ongoing financing and development of that service.

Regarded as a whole, one must notice that this is actually the conceptual core of the idea of local autonomy, which does not simplistically and uncommittedly refer to accomplishing some given, predetermined tasks at local level, for which central authority allows freely choosing the manner of performance, but to local initiative, commitment, differentiation, selectivity, adding value and performance in line with freely decided and undertaken development goals, within the general legal framework. In other words, a local authority which will complete the tasks it has efficiently, without disruptions, and for which it is legally responsible (sanitation, water/sewage, lighting etc.), without however creating any adjacent necessary services, required or useful for the members of the subnational collectivity, allowed but not imposed by law, which to express and support local development and identity, will be at least likely of not capitalizing the legal attribute of local autonomy.

CONCLUSIONS

Against the background of a fragile economic base and therefore of a very reduced fiscal potential, local financial management in Romania is still reduced, in many cases, to the mere administration/ management of some financial resources allocated by public authorities superior to the local level, with negative implications for the accountability and responsibility of involved local actors. The main current problems are the extremely low involvement of citizens in the local budgetary process, the use, as a rule, of the system of inter-administrative transfers, the desynchronization of the transfer of competences with that of resources and of the applicability of the principle of collaboration and cooperation between public authorities. The (legislative and administrative) reform efforts in this area must necessarily be associated with awareness-raising initiatives and actions concerning the role of each of the involved actors (accountability), strengthening their responsibility in setting and insuring a convenient trajectory for the development of the local community.

REFERENCES

Bovaird, T. şi Löffler, E. (eds.), 2009 – Public Management and Governance, New York: Routledge.

Hoorens, Dominique (coord.), 2004 – Local finance, Paris: Dexia Editions.

Onofrei, M., 2007 – Public Administration. Scientific Fundamentals and Best Practices, Iaşi: „Al. I. Cuza” University.

Onofrei, M., 2007 – Financial Management, Bucharest: C.H. Beck Publishing House.

Oprea, F., 2011 – Public Budgetary Systems. Theory and Practice, Bucharest: Economică Publishing House.

Oprea, F., 2013 – Financial Management of Local Collectivities, Bucharest: Tritonic Publishing House.

Orsoni, Gilbert, (coord.), 2007 – Les finances publiques en Europe, Paris: Economica.

Popescu A. 2015 – Financing democracy or corruption? Political Party Financing in the EU Southeastern and Eastern Member State, CES WORKING PAPER SERIES, vol.7, no. 2A, p.573-p.581

Shah, A., (editor), 2007 – Intergovernmental Fiscal Transfers – Theory and Practice, Washington: World Bank.

Shah, Anwar, (editor), 2007 – Local Budgeting, Washington: World Bank.

*** – Specific legislation in the field of administration and local public finances.

[1] „Alexandru Ioan Cuza” University of Iaşi

DOWNLOAD FULL ARTICLEArhive

- aprilie 2025

- martie 2025

- februarie 2025

- ianuarie 2025

- decembrie 2024

- noiembrie 2024

- octombrie 2024

- septembrie 2024

- august 2024

- iulie 2024

- iunie 2024

- mai 2024

- aprilie 2024

- martie 2024

- februarie 2024

- ianuarie 2024

- decembrie 2023

- noiembrie 2023

- octombrie 2023

- septembrie 2023

- august 2023

- iulie 2023

- iunie 2023

- mai 2023

- aprilie 2023

- martie 2023

- februarie 2023

- ianuarie 2023

- decembrie 2022

- noiembrie 2022

- octombrie 2022

- septembrie 2022

- august 2022

- iulie 2022

- iunie 2022

- mai 2022

- aprilie 2022

- martie 2022

- februarie 2022

- ianuarie 2022

- Supliment 2021

- decembrie 2021

- noiembrie 2021

- octombrie 2021

- septembrie 2021

- august 2021

- iulie 2021

- iunie 2021

- mai 2021

- aprilie 2021

- martie 2021

- februarie 2021

- ianuarie 2021

- decembrie 2020

- noiembrie 2020

- octombrie 2020

- septembrie 2020

- august 2020

- iulie 2020

- iunie 2020

- mai 2020

- aprilie 2020

- martie 2020

- februarie 2020

- ianuarie 2020

- decembrie 2019

- noiembrie 2019

- octombrie 2019

- septembrie 2019

- august 2019

- iulie 2019

- iunie 2019

- mai 2019

- aprilie 2019

- martie 2019

- februarie 2019

- ianuarie 2019

- decembrie 2018

- noiembrie 2018

- octombrie 2018

- septembrie 2018

- august 2018

- iulie 2018

- iunie 2018

- mai 2018

- aprilie 2018

- martie 2018

- februarie 2018

- ianuarie 2018

- decembrie 2017

- noiembrie 2017

- octombrie 2017

- septembrie 2017

- august 2017

- iulie 2017

- iunie 2017

- mai 2017

- aprilie 2017

- martie 2017

- februarie 2017

- ianuarie 2017

- decembrie 2016

- noiembrie 2016

- octombrie 2016

- septembrie 2016

- august 2016

- iulie 2016

- iunie 2016

- mai 2016

- aprilie 2016

- martie 2016

- februarie 2016

- ianuarie 2016

- decembrie 2015

- noiembrie 2015

- octombrie 2015

- septembrie 2015

- august 2015

- iulie 2015

- iunie 2015

- mai 2015

- aprilie 2015

- martie 2015

- februarie 2015

- ianuarie 2015

Calendar

| L | Ma | Mi | J | V | S | D |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

Lasă un răspuns

Trebuie să fii autentificat pentru a publica un comentariu.