ASPECTS CONCERNING LEGAL LIABILITY IN THE INSURANCE SECTOR

Carmen Toderașcu - decembrie 5, 2016Carmen TODERAŞCU (SANDU)[1], Bogdan FÎRŢESCU[1]

e-mail: carmentoderascu@gmail.com

Abstract

(Civil) liability insurance covers damages caused by policyholders (natural or legal entities) to third parties, damages that appear in certain situations and for which the policyholder responsible for their occurrence is held liable by law. In time, economic and social importance of civil liability insurance has been recognized, and it has recorded a continued progress, especially in this last period. Civil liability insurance has diversified adapting to changes of the socioeconomic and professional environment, which it is meant to support. Diversification and amplification are revealed through the involvement of the State in this field, as a series of insurance of this type became mandatory by law (civil liability insurance for motor vehicles). In this context, our work is designed as an interdisciplinary analysis of the role of insurance and related (legal) liability in strengthening social responsibility, in support of ensuring functionality of contemporary societies.

Key words: social responsibility, civil liability, insurance, civil liability insurance for motor vehicles, ASF

Insurance is an important sector of our national economy. The insurance market meets the insurance demand that comes from natural persons, but also from economic operators that are eager to conclude various types of insurance (including civil liability insurance for motor vehicles), products which are part of the insurance supply supported by specialized organizations authorised to work in this field and that have the financial capacity to carry out these operations. (Constantinescu Dan Anghel, 2004).

MATERIAL AND METHOD

In his work “Asigurari si reasigurari – O perspectiva globala” (Insurance and reinsurance – A global perspective) (2011), V. Ciurel claims that the insurance market has a series of features, such as: market size, organizational structure, structure and achievement of competition. Market size is determined by the size of insurance demand and is expressed by the following indicators: contracts concluded in a given period of time, annual amount of insurance premiums, value of the amounts insured in a given period and total value of commitments entered into by the insurer at a given time.

RESULTS AND CONSIDERATIONS

Hereinafter, we try to analyse civil liability insurance for motor vehicles since it ranks first in the top of compulsory insurance policies concluded on the Romanian insurance market. Demand for civil liability insurance comes from natural/legal entities who wish to ensure themselves against damages they may cause accidentally, as a consequence of negligence or imprudence, to other persons, to whom they are responsible in front of the law. Legal civil liability insurance covers the amounts that a person owes to third persons, in case of damage or injury thereto. The insurance policy also covers compensation for any legal costs.

Civil liability insurance for motor vehicles – leader on the market of compulsory civil liability insurance

The legal basis of insurance market is Law 136/1995 on insurance and reinsurance in Romania. This law has undergone a number of changes, the last being that brought by Law 304/2007 published in the Official Gazette No. 784 of 19.11.2007. Law 32/2000 concerns insurance and insurance surveillance activities, the last amendment being made by Law 289/2010 in the Official Gazette, Part I, No. 892 of 30.12.2010. The regulatory body supervising insurance activities in our country is the Financial Supervisory Authority (Autoritatea de Supraveghere Financiara – ASF).

Civil liability insurance against damages or bodily injury produced by car crashes plays an important role in the context of the increasing number of motor vehicles travelling on public roads. Under these circumstances, protecting the victims of traffic accidents has become a social matter with major implications. This paper focuses on the analysis of the civil liability insurance for motor vehicles also because its main characteristic concerns both the interest of the injured third-party and the interest of the person who caused the damage. Civil liability insurance for motor vehicles is concluded between a natural/legal entity and an authorized insurer, with the main purpose of providing financial protection of the party guilty of causing the accident. By not concluding the compulsory civil liability insurance for motor vehicles or by not permanently maintaining its validity through payment of insurance premiums, the owners of motor vehicles commit an offence that shall be penalized with a fine and confiscation of the vehicle registration certificate. Should the risk occur, recovery of damage can be pursued in Court.

This insurance product is considered to be compulsory across the European Union. Insurers may extend territorial validity of the policy. The insurance contract may include additional terms; by addenda, insurers may set higher claim limits if additional insurance premiums are paid.

The owner of a vehicle must hold a valid civil liability insurance for motor vehicles throughout the period in which the vehicle is registered, even if it is not used. In Romania, the first ten companies have cumulatively written gross premiums of approximately EUR 770 million and noted a decrease of almost 3% of the European currency.

Civil liability insurance for motor vehicles covers damages caused to a third person by an accident produced with a vehicle holding a valid insurance policy. If the insured event occurred during the period of validity, damage is compensated by granting certain amounts of money for events such as bodily injury or death, material damage, damages consisting in the impossibility to use the damaged vehicle, court expenses incurred by the injured person in civil proceedings.

The Financial Supervisory Authority has established the following claim limits:

For damage to property produced in one and the same accident, regardless of the number of people injured, claim limit is fixed at a level of Euro 1 million;

For bodily injury and deaths, including for non-material damage caused in one and the same accident, regardless of the number of people injured, claim limit is fixed at a level of Euro 5 million.

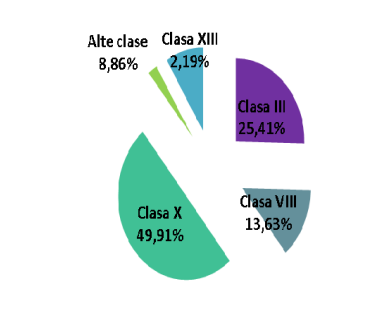

Share of the main insurance classes of the total gross premiums written in September 2015

Figure 1 Other classes = 8.86 %, Class XIII = 2.19 %,

Class III = 25.41 %, Class VIII = 13.63 %, Class X = 49.91 %

Encoding: Class X – Civil liability insurance for motor vehicles, Class VIII – Fire and natural disasters, Class III – Means of land transport, other than railway, Class XIII – General civil liability.

The analysis conducted shows that the insurance market is divided into sub-markets depending on the insurance provided, but an important role in the market is occupied by general insurance, which includes: insurance for motor vehicles, marine, transport and aviation insurance, home insurance, agricultural, credit and security insurance etc.

In Iasi county, civil liability insurance for motor vehicles has a market share of about 1.8 % of the general insurance market, being one of the 13 counties (except for Bucharest) which exceed the annual threshold of Lei 100 million in terms of gross premium written. Underwriting related to civil liability insurance for motor vehicles represents about 45 % of the total non-life insurance in Iasi, a weight close to the national average.

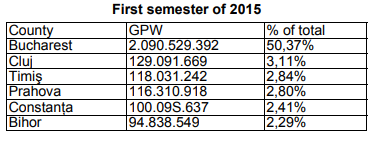

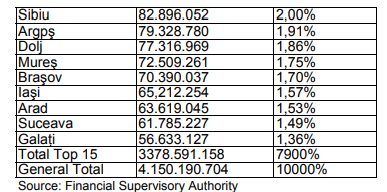

A synthetic image of the evolution of civil liability insurance for motor vehicles is shown in the table below:

Top 15 counties according to gross premiums written (general insurance + life insurance)

IMPACT OF BONUS-MALUS SYSTEM

The Financial Supervisory Authority regulates the bonus-malus system by the rules issued and it represents a measure for ensuring accountability of vehicle owners with the aim of allowing prudent vehicle owners not to pay an insurance premium as high as that paid by vehicle owners producing accidents.

The bonus-malus system influences the insurance premium depending on the claim frequency in a given period of time. If during the reference period there were no claims, upon renewal of their insurance, policyholders will get a bonus, consisting in a discount in the insurance premium. If there were claims, upon renewal of the insurance policy, penalties will be charged by applying an increase in the insurance premium (malus). Malus becomes valid upon renewal of the insurance policy in the year following the year of the claim. The bonus-malus system includes 14 classes of bonus (B) and 8 classes of malus (M). The maximum discount is of 50%, and the maximum penalty is 200%. Class B0 is assigned to a new policyholder, without history of damages. Each class is associated a specific percentage of discount or increase, respectively, to the insurance premium, in relation to B0 basic class. Thus, if during the reference period (the calendar year preceding the date of policy issue) there were no claims, the policyholder will benefit next year of a discount in the insurance premium, consisting in granting 1 or 2 bonus classes, depending on the period for which the new policy is concluded (6 months or 1 year).

CONCLUSIONS

From the beginning of the following year (January 1, 2016), Directive 2009/138/EC of 2009 shall enter into force, also known under the name of Solvency II – which shall be applied to all insurance and reinsurance companies with an annual premium volume of over Euro 5 million or with technical reserves of over Euro 25 million. We believe that this measure will lead to an increase of the tariffs in civil liability insurance for motor vehicles, which will result in a decrease in the number of policies concluded. Civil liability insurance for motor vehicles (“green card system”) is mandatory and has the role of compensating damages caused in an accident, including claims relating to personal injury, death or moral damages.

REFERENCES

Ciurel, V., 2011 – Insurance and reinsurance: A global perspective, Rentrop&Straton Publishig House, Bucharest.

Constantinescu, D.A., 2004 – Insurance Treatise, volumes I and II, Economică Publishing House, Bucharest.

Fîrţescu, B., 2010 – The financial system of Romania, “Al. I. Cuza” University’s Publishing House, Iaşi.

Lungu, N. C., 2006 – Insurance fundamentals, Sedcom Libris Publishing House, Iaşi.

Toderaşcu, C., 2013 – The exchange rate and its impact on international economic relations, Iaşi, Sedcom Libris Publishing House.

Văcărel, I., Bercea, F., 1998 – Insurance and reinsurance, Expert Publishing House.

*** – http://www.asfromania.ro/

[1] “Alexandru Ioan Cuza” University of Iasi, Faculty of Economics and Business

DOWNLOAD FULL ARTICLEArhive

- mai 2025

- aprilie 2025

- martie 2025

- februarie 2025

- ianuarie 2025

- decembrie 2024

- noiembrie 2024

- octombrie 2024

- septembrie 2024

- august 2024

- iulie 2024

- iunie 2024

- mai 2024

- aprilie 2024

- martie 2024

- februarie 2024

- ianuarie 2024

- decembrie 2023

- noiembrie 2023

- octombrie 2023

- septembrie 2023

- august 2023

- iulie 2023

- iunie 2023

- mai 2023

- aprilie 2023

- martie 2023

- februarie 2023

- ianuarie 2023

- decembrie 2022

- noiembrie 2022

- octombrie 2022

- septembrie 2022

- august 2022

- iulie 2022

- iunie 2022

- mai 2022

- aprilie 2022

- martie 2022

- februarie 2022

- ianuarie 2022

- Supliment 2021

- decembrie 2021

- noiembrie 2021

- octombrie 2021

- septembrie 2021

- august 2021

- iulie 2021

- iunie 2021

- mai 2021

- aprilie 2021

- martie 2021

- februarie 2021

- ianuarie 2021

- decembrie 2020

- noiembrie 2020

- octombrie 2020

- septembrie 2020

- august 2020

- iulie 2020

- iunie 2020

- mai 2020

- aprilie 2020

- martie 2020

- februarie 2020

- ianuarie 2020

- decembrie 2019

- noiembrie 2019

- octombrie 2019

- septembrie 2019

- august 2019

- iulie 2019

- iunie 2019

- mai 2019

- aprilie 2019

- martie 2019

- februarie 2019

- ianuarie 2019

- decembrie 2018

- noiembrie 2018

- octombrie 2018

- septembrie 2018

- august 2018

- iulie 2018

- iunie 2018

- mai 2018

- aprilie 2018

- martie 2018

- februarie 2018

- ianuarie 2018

- decembrie 2017

- noiembrie 2017

- octombrie 2017

- septembrie 2017

- august 2017

- iulie 2017

- iunie 2017

- mai 2017

- aprilie 2017

- martie 2017

- februarie 2017

- ianuarie 2017

- Supliment 2016

- decembrie 2016

- noiembrie 2016

- octombrie 2016

- septembrie 2016

- august 2016

- iulie 2016

- iunie 2016

- mai 2016

- aprilie 2016

- martie 2016

- februarie 2016

- ianuarie 2016

- decembrie 2015

- noiembrie 2015

- octombrie 2015

- septembrie 2015

- august 2015

- iulie 2015

- iunie 2015

- mai 2015

- aprilie 2015

- martie 2015

- februarie 2015

- ianuarie 2015

Calendar

| L | Ma | Mi | J | V | S | D |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | ||||||

Lasă un răspuns

Trebuie să fii autentificat pentru a publica un comentariu.